When Shelby Lattimore saw her students weren't attending class, she found a fun and unique way, outside of the traditional curriculum, to encourage them not only to show up but to get excited about learning.

Lattimore, a math and science teacher at a Title 1 school in Charlotte, North Carolina, said her system of assigning jobs, giving out "paychecks," charging things like "rent" or a "fine" and then offering rewards has worked so well that her third graders are now "bought in" to their class economy.

"The reason why I started my class economy is to motivate my students to have better attendance and to come to class and be excited to be here, as well as to keep them accountable for their behavior," the 25-year-old teacher explained.

Since the fall of 2022, Lattimore, who has been teaching for the last four years, has developed an ongoing program that draws from her own real-life experiences and adapts them to age-appropriate "jobs" and rewards. She said she also takes suggestions from her students and modifies the class economy to align with her students' progress.

"It wasn't like I wanted to implement this because I saw it somewhere else," Lattimore said. "When it started off, I'm like, 'Yeah, I pay rent. You pay rent. I've got a job. You've got a job.' So that's kind of how it developed."

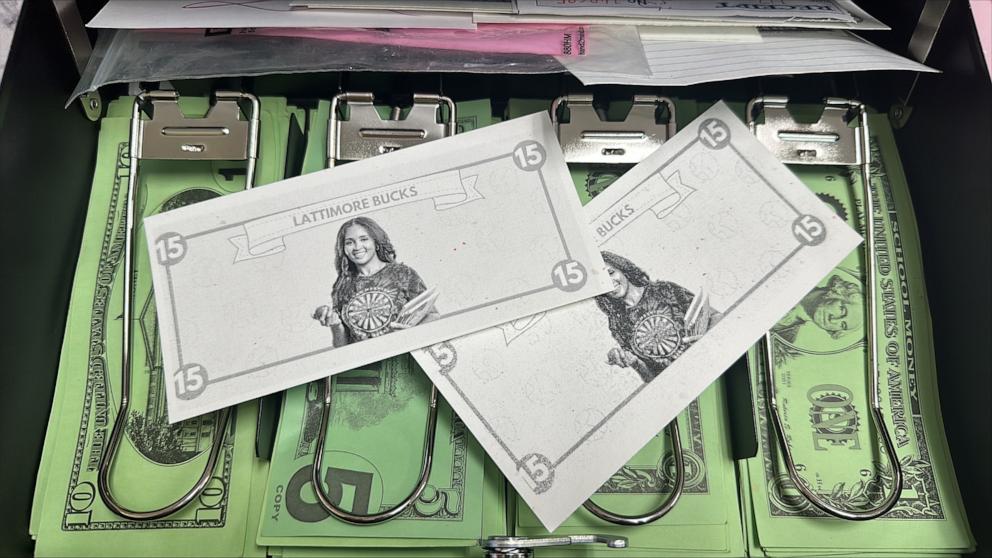

Lattimore first started sharing her class economy approach to show family and friends in a TikTok video last October, where it quickly went viral. At first, social media followers thought Lattimore was collecting real money from students but as she explained to "GMA," her third graders earn and use play money, including the special $15 "Lattimore Bucks," which she introduced this school year.

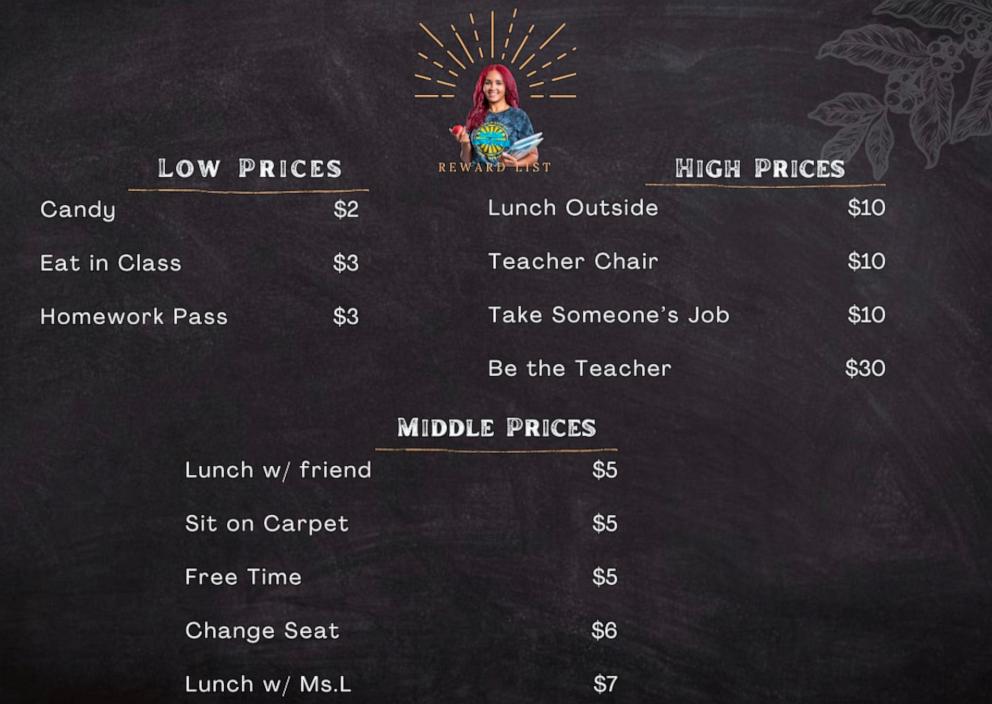

"There are three main aspects of what is going on in the class. [One is] jobs, so they get 'paid' for their jobs. Two [is] any type of bills or fines so that can be rent and fines where they're paying me. And then three, our reward system, to reward good behavior," Lattimore explained. "They get to buy things and it's not always tangible things. It could just be eating lunch upstairs, or eating with me, [or] being the teacher for the day."

Students can choose from a variety of "jobs," from being a door holder or line leader to being a cleanup crew member or the class pet helper for their class fish, Knuckles. They get "paid" every two weeks and the amount they get depends on which job they take on.

Each month, Lattimore's students also have to "pay rent" for their class desk and chair and to keep things interesting, Lattimore also introduced a new idea to her current class in January.

"In the beginning of the school year, they paid $5 and then once the new year hit, their rent was inflated to $7," Lattimore explained. "So that was kind of an adjustment that they had to make and then they can buy rewards once a month."

Students' rewards are also divided into low, medium and high price ranges, with $2 candy being the cheapest option to a more expensive $7 "lunch with Ms. L" reward. Students can also save up to "take someone's job" for $10 or work up toward the most expensive reward, being the teacher for $30.

Today, Lattimore said her third graders have embraced the class economy and she has seen how much they've learned about various concepts from budgeting and saving to reading a receipt and counting change.

"Now, they're running it and I just observe and I just make sure that everything is safe and everything is what it needs to be," Lattimore said. "It's a good lesson to learn because they're learning basic financial literacy skills without the real-life consequence of actually doing it in the real world."

Lattimore said she is working on creating a manual for other teachers and parents to follow and her most valuable lesson learned so far is to "start slow."

"You really have to see what they're grasping and if they're ready for the next step," she said.

As her third graders grow to enjoy learning about the value of money, how an economy works and what they can do in their futures, Lattimore said it's a lesson she wishes she had when she was in school.

"I never had a class like this when I was growing up at all," Lattimore said. "I honestly wish I did because who knows what I would have learned by now, because I'm still learning about financial literacy as a 25-year-old, so I can only imagine what I would know."

Lattimore said she has also heard from students' families, some of whom have been impacted by generational poverty and are supportive of the class economy idea.

"A lot of my students' parents, they thank me when they hear about what's going on in the classroom because their kids are learning something that they never learned at this age," Lattimore said. "They're like, 'Oh, I'm excited to see if my child or my grandson or my granddaughter or niece, nephew can now change the lineage of their families."

"That's really the goal here, to not just impact them this year, but to keep it going," she added.