How reframing your approach to finances can alleviate stress and help with self-care

Money is a common cause of stress, but applying self-care to approach finances is a great way to alleviate stress and refocus your mind.

As part of "Good Morning America's" Self Care Nation series, ABC News' chief business correspondent Rebecca Jarvis shared tips to reframe the way people look at finances.

Money is the second leading cause of stress in America, according to a 2017 study from American Psychological Association. Jarvis said it's all about reframing the way we look at our finances.

Finances can feel like a messy puzzle, with various pieces like stress, credit card debt, mortgage, expenses and savings scattered about. The chaotic and overwhelming nature of these financial pieces add to stress, but even if you can't change these things immediately, you can shift the way you approach it and take control.

How to rethink the way you look at finances

Create a snapshot and set goals

Start by looking at how much you earn weekly, how much you spend, debt and savings.

Use a financial tracking app like Mint

Mint pulls all of your financials under one roof, including bills, credit cards and more, to track where you're spending and how much. You can also set goals through the app, like paying down debt by a certain time, and the app will advise what you need to put towards each payment.

Make a budget

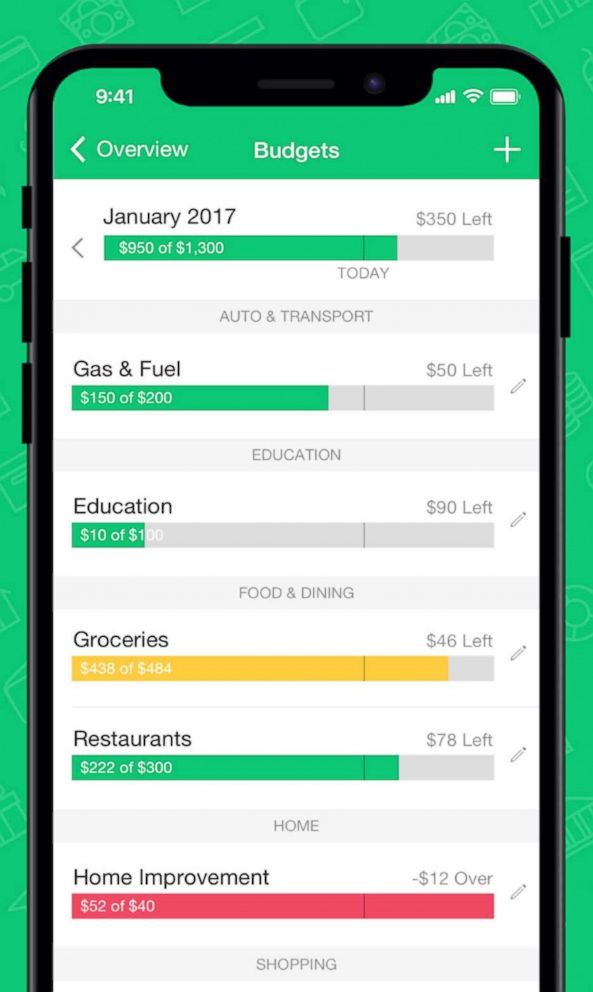

Budgets are about planning ahead and holding yourself accountable. Use a money management app like Pocketguard to help track your spending compared to your budget throughout the month. This will also help you find the best deal on monthly service costs.

Track your progress

Some months will be better than others and sometimes you may realize that a particular budget plan doesn't work for you, but take control of that and own the next steps.

Although the process can at times be overwhelming, once you reframe it like this, there is no room for added stress.